The following is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Word of the Day: Volatility

Are you ready for increased volatility? It is common for markets to become more volatile as we go deeper into bear markets. As uncertainty, illiquidity and impatience increase, more and more market participants begin to hope for market extremes: either the market has bottomed out and a new bull cycle is at a Federal Reserve pivot, or limit down, margin call sell-out day is imminent due to a Credit Suisse meltdown. Everyone latches onto every major market move to give them some sort of signal. Price ranges begin to widen and some (potential) weekly or monthly movements are condensed into a single day of action.

Even arguably one of the best investors of all time, Stanley Druckenmiller, finds today one of the most difficult environments to understand:

“I’ve been doing this for 45 years and between the pandemic, war and the crazy political response in the United States and around the world, it’s the most difficult environment I’ve ever encountered to try to have faith in a forecast of six to twelve months ahead. .”

For the most part, it’s best to stay out of the action and have a large risk position ready to deploy once markets stabilize or calm down.

We are still of the opinion that new lows are likely to be reached and that we have not yet drawn a definitive conclusion on the cycle for equities, risk assets and bitcoin.

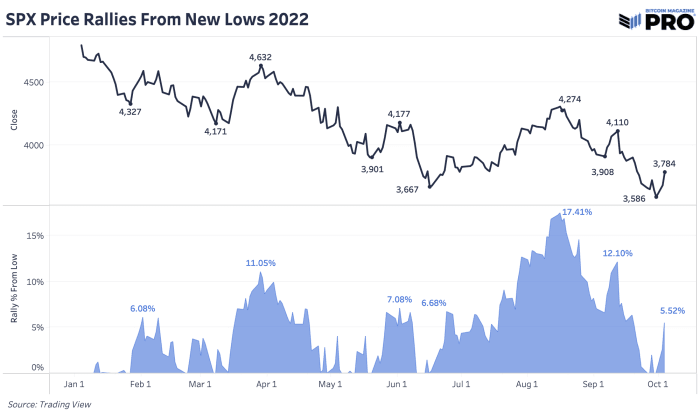

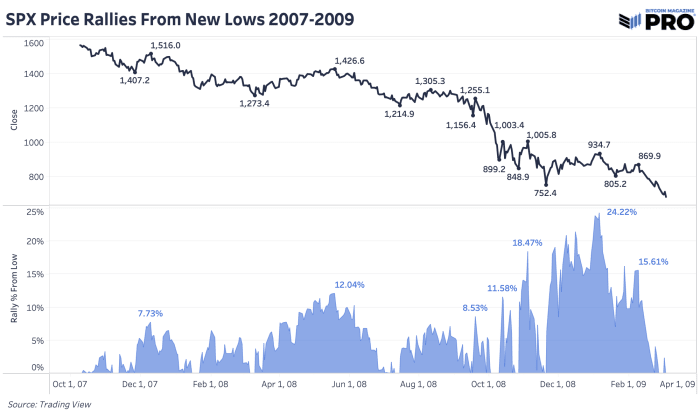

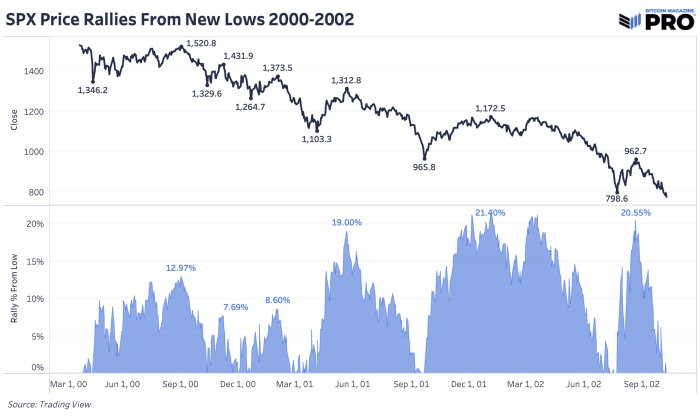

We will remind readers of the magnitude of the bear market rallies we have seen so far and the magnitude of those rallies in 2000 and 2008 analogous. There are other cycles to study and compare but these are just a few recent examples.

We have already seen a significant 17.41% rally from the lows for the SPX with bitcoin hitting $25,000. Still, that hasn’t changed its next downside reversal and, what we think, is that the medium-term bearish trajectory continues. Even in the last crashes of 2002 and 2009, the S&P 500 saw rallies of more than 20% before falling. As the market piles up in bloody too short terms and doomsday news about higher leverage, remember there is no free lunch.

Another interesting point to note is that bear markets are usually short and last an average of 10 months. This 10 month benchmark would put us roughly where we are today. Yet there is a helpful idea and thesis to make that the current destruction we have seen so far is about readjusting to a unique and historic time for rates, bonds and credit. We have barely arrived at what is the Classic and Cyclical Earnings Bear Market.

While bonds, currencies and global equities have all continued to trade with increasing levels of volatility, bitcoin’s recent historical and implied volatility is oddly subdued by historical standards.

While bitcoin’s lack of recent volatility could be a sign that much of the bull market’s leverage and speculative mania has been almost entirely erased, our eyes remain on the outsized legacy markets for signs. fragility and volatility, which could act as a headwind in the short/medium term.

While the world around bitcoin’s price action seems to be growing increasingly uncertain, the bitcoin network remains completely unchanged at the protocol level, continuing to do its job as a neutral currency asset/settlement layer, despite the volatility of its exchange rate.

Tick tock, next block.

Relevant previous articles