The below is a direct extract from Marty’s Bent Number 1269: “Interesting reaction from the UK” Subscribe to the newsletter here.

Going through Shares

Here is a painting that has lingered in my mind throughout the week. It was shared by the Coinshares team and highlights bitcoin trading volume in the UK earlier this week as the pound plummeted. As you can see, volumes exploded to just under $900 million, reaching their highest level in over two years. It is difficult to discern the intention of those who traded bitcoins in size in the UK. It could have been people looking to take advantage of rapidly developing arbitrage opportunities, people looking to sell bitcoin to get cash to service failing trades, or people looking to buy. bitcoin as a hedge against rapid currency depreciation.

We can’t say for sure, but if volumes were driven by those seeking security in bitcoin, it would represent a very interesting turning point for the nascent digital monetary good and how it is viewed by the wider market. . One has to imagine that there are forex traders watching the landscape of rapidly deteriorating fiat currencies around the world and starting to panic, especially when currencies like the pound and yen crash like they have. been for the past two weeks. . Even if the dollar is tearing up, it’s the finest shit in the heap. Its relative strength doesn’t seem so strong when you consider the problems that exist across the US economy as a whole: inflation is high, energy policy is suicidal, and rising rates are starting to hit US consumers hard. , especially homeowners and those with large amounts of credit.

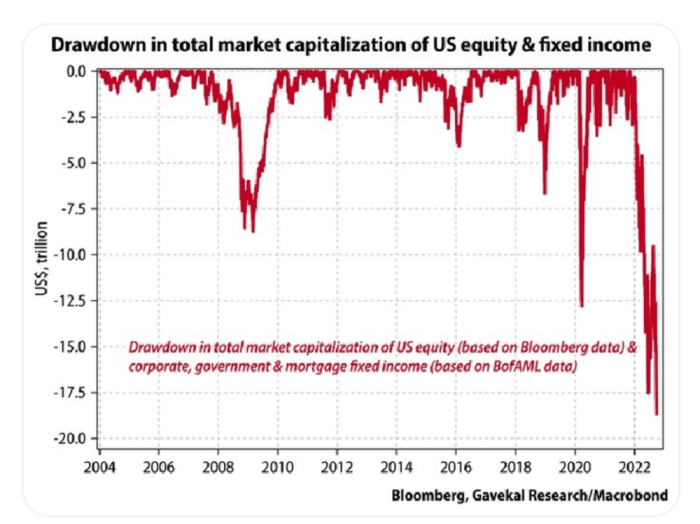

With all of this taken into consideration, it is not hard to believe that more and more people are beginning to realize that bitcoin is a very attractive asset to exploit as protection against this madness. The network is distributed, its supply is finite and it is easy to hold without taking counterparty risk. Compared to other currencies, bonds, and stocks in a world on fire, bitcoin’s superior properties stick out like a sore thumb. Who knows whether or not the trading volume out of the UK indicates growing recognition of bitcoin’s value proposition, but you should definitely have this potential trend on your radar, especially given the amount of wealth that has been destroyed so far this year.