The text below is from a recent edition of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Volatility spikes, Bitcoin follows

We’ve covered the relationship between stock market volatility and bitcoin’s price action extensively since the start of the new year, as the inverse correlation between bitcoin’s price and the VIX (S&P 500 Volatility Index) remains extremely strong. . Volatility rose further today as markets reacted to Putin’s speech yesterday recognizing the independence and sovereignty of the Donetsk People’s Republic and the Luhansk People’s Republic.

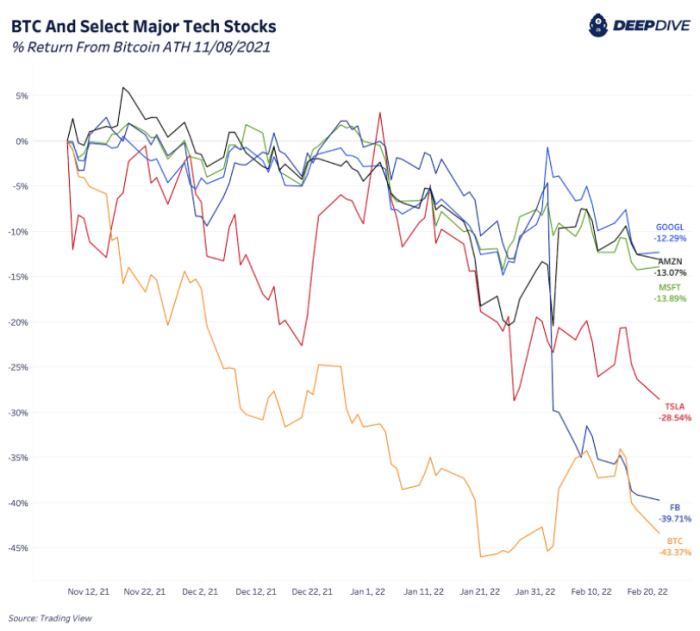

With bitcoin currently down 43% from highs at the time of writing, other assets (particularly the tech sector) have been hammered lately. Below, we’ve compared bitcoin’s performance since its all-time high with selected top tech stocks across Google, Amazon, Microsoft, Tesla, and Facebook.

Although bitcoin was the worst performer of the bunch over the selected time frame, bitcoin market volatility is historically high compared to other asset classes, due to cycles of monetization and adoption of the monetary asset.

bitcoin and the dollar

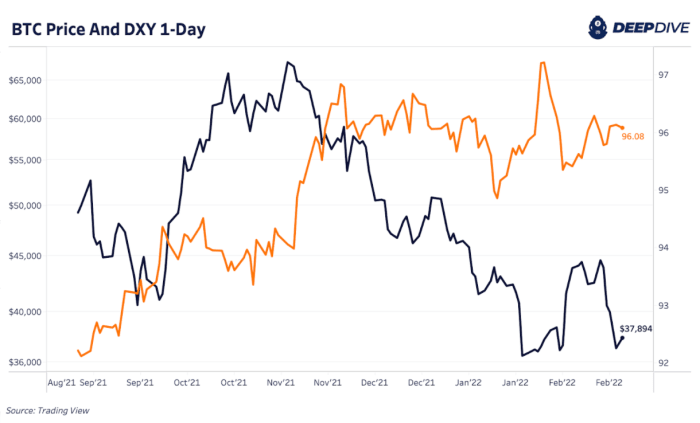

Likewise, we have been watching the DXY (US Dollar Currency Index) and its relationship with the bitcoin market, as the USD strengthens against other foreign currencies.

A strengthening dollar appears to be inversely correlated to a sell off in bitcoin and other risky markets.

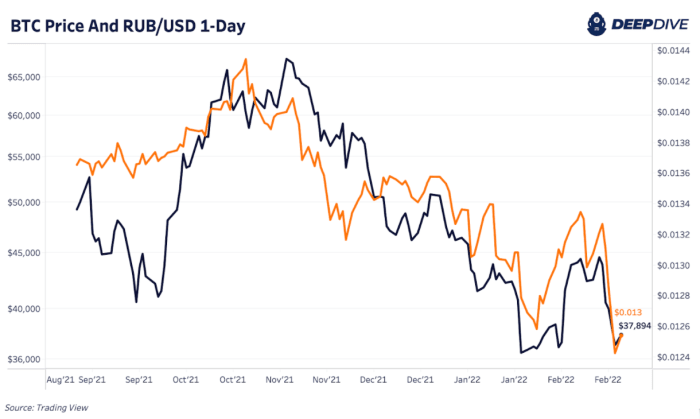

A rather interesting development recently has been the correlation between the Russian ruble and the price of bitcoin over the past few months. As global risk markets sold off on news that Russia could become embroiled in a dispute with Ukraine, the ruble weakened against the dollar, alongside bitcoin’s slide.

Although there are a multitude of reasons for this potential correlation, it is most likely due to the flight to safety of risky assets (towards the dollar) since the fourth quarter of 2021.