The text below is from a recent edition of Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

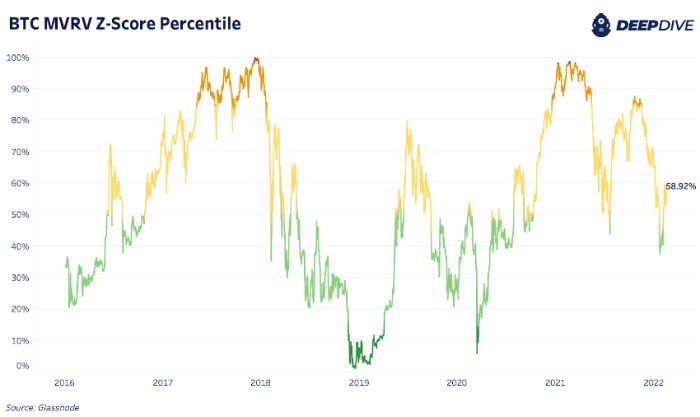

In today’s Daily Dive, we’ll cover some of the major on-chain cycle indicators and what they tell us about where we are in the market. All indicators today rely on percentile analysis, looking at current values against historical percentiles, to show when indicators suggest the market is at lows, highs, neutral, or somewhere in between.

Of the roughly 20 on-chain cycle indicators we track, the channel shows a neutral to bullish market setup. Yet, we know that chain, macro, and derivatives all play a role in bitcoin’s growth trajectory, especially with high correlations between bitcoin risk and equities right now.

The Market Value to Realized Value (MVRV) ratio is a metric we cover extensively as it incorporates the current state of the price relative to bitcoin’s on-chain cost basis or “fair value”. The MVRV Z-Score incorporates the standard deviation of market capitalization to produce a higher quality signal.

At previous bitcoin highs of 2021, we have not seen cycle highs play out like previous cycles. But with less benefit, it also likely brings less prolonged downside. Currently, bitcoin’s MVRV Z-Score indicates a neutral market state after the price broke from the $30,000 range several times. Another shift to an “overcooled” dark green state, where the value is below its 15th percentile, seems unlikely, barring a black swan sell-off type event.

A cumulative 90 Days of Coins Destroyed (CDD) view is another key indicator that helps show long-term holder activity. Although we saw an increase in the number of days of coins destroyed during the May 2021 high, we did not see much spending activity during the November 2021 high. been observed in older coins, suggesting that most “smart money” holders are currently stuck.