The following is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Thursday, May 12, 2022 was one of the most exciting and active days in the bitcoin/crypto market in months, with no shortage of volatility or fear from market participants. On the bitcoin side, the price fell to a low of $25,300 on heavy volume, before rebounding quickly and closing the daily candle at $28,900. With the fall, opportunistic investors reacted strongly looking to buy the drop, as seen in the Canadian Purpose Bitcoin ETF, which saw its biggest day of inflows yet, adding 6,902 BTC worth nearly $207 million.

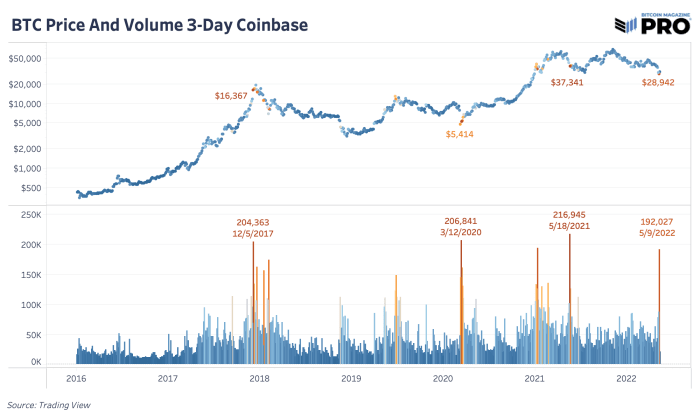

Likewise, Thursday saw the highest single-day bitcoin volume traded on Coinbase since May 19, 2021, signaling that a significant amount of bitcoin changed hands on the most dominant cash exchange in the United States. Looking at Coinbase’s 3-day volume bars for bitcoin, large spikes are usually signals of inflection points near local lows or highs. While there is obviously a whole confluence of variables that must be considered when looking for absolute lows in the market, a sharp increase in volume in spot markets and a subsequent bounce above $30,000 for bitcoin is a promising sign.

This aligns with our macro view that the U.S. economy is in the midst of a significant stagflationary slowdown, which is hurting asset prices and driving less liquidity in financial markets as the Federal Reserve tightens monetary policy. . As consumers continue to squeeze their wallets, the slowdown in economic activity will worsen in a positive feedback loop of growth and declining economic activity.

Our central thesis is that this will inevitably lead to additional fiscal and monetary stimulus, as the global economy cannot handle a sustained economic downturn due to the mechanics of the debt-based monetary system we find ourselves in today. today, with a record amount of debt that needs to be serviced and refinanced.

Subscribe to access the full Bitcoin Magazine Pro newsletter.