Acknowledgments: Derek Pennings invented “The Entry Indicator”. I helped him put the thought process in writing. You can find him on Twitter @PenningsDerek.

Not yet

It happened. Again. The price has fallen more than 50% from its all-time high. At times like these, people wonder if the bottom is there or not. Nobody wants to sell the bottom. And nobody likes buying a dip that keeps on dipping either.

There are many indicators. Some of them are called “chain” indicators and some are technical price indicators. For example, the Relative Strength Index (RSI) over the daily time frame. When it hits 20 or less, that’s really something. Or what about Fibonacci levels? All great indicators to get an idea of price action. But does that make it a great entry indicator? This can be useful, but it is always relative to previous price action, which is not a fundamental threshold. It’s technical.

Realized price

So, which indicator has a fundamental threshold? We like to keep a close eye on the realized price. In a previously written article, we explain how we look at the bitcoin price (market) with the realized price as the anchor. When the price of bitcoin breaks below the realized price, it means that, on average, bitcoin HODLers are at a loss. Early investors may still make a profit, but most investors are at a loss.

As of January 31, 2022, the realized price was approximately $23,900. In the history of bitcoin, it rarely happens that the market price reaches this level or even drops below it. But even when it does, it doesn’t exactly mark the bottom. Yes, it’s a damn good place to pile on a few extra sats, but will the price stop dropping at that level? On January 14, 2015, that was definitely not the case. With a realized price of $310.91 and a market price of $172.21, it went much lower. This may have been because the second bull market peak of 2013 was an outlier and the realized price was at the top of the “normal technology adoption curve”. We could expand on this hypothesis in another article, but for now, let’s focus on an entry point.

Adjusted realized price

There have been times when the bitcoin price has undergone a sharp correction and the price has rallied before touching or approaching the realized price. Since 2020, big investors are stepping in and changing the rules of the game. Michael Saylor likes to add bitcoin to his balance sheet when the price drops and President Bukele also smashes the buy button on his phone when the price drops. Thus, it may take years for the bitcoin price to reach the realized price again. It may never, ever happen again. Are you ready to wait for this?

So what if we adjust the realized price for lost coins. Pieces that have not been moved for more than seven years may never move again. The adjusted realized price is approximately $30,649 (depending on how you calculate it). It may seem more realistic. We have already seen a wick at $33,000. But even this adjusted realized price is not always a perfect entry indicator.

Frame for an entry indicator

But what makes an entry indicator a good entry indicator? Let’s think about it. There are a few factors you want to consider. The first one is the moment in time. Since the bitcoin rate that inflates the total circulating supply halves every four years, you can consider buying if a halving is near or you can wait longer if a halving has just happened. produce 18 months ago and the next one is still 30 months away.

The second is the difference between the expected valuation of bitcoin during that certain halving period and the actual market price. If the current price is much lower than the expected price, you can consider buying, and if the price is equal or higher, you can expect a lower price.

The third is the current state of the market. Are short-term holders panicking again and panicking selling? Do the long-term holders keep their faith or do the diamond hands even turn into paper hands?

Stock-flow deviation

Almost everyone in the Bitcoin space has heard of the stock-to-flow (S2F) model. He values bitcoin by its rarity. The deviation is the current price divided by the stock-flow model valuation. Stock-to-flow has become a very controversial model. It is probably (much) too bullish in the long term, as it has no built-in diminishing returns, but there is empirical evidence that there are diminishing returns in bitcoin.

But the model could still be very useful. What it does is assess the price of bitcoin during a specific halving (hold). And it is useful to distinguish in which period you are between the halves (time). Even if the expected value of S2F turns out to be too high, it can still be used in an entry indicator. Why? Because we are creating a ratio and if the S2F price is too high, the “green zone” of the ratio will be lower than if S2F was (entirely) correct.

Profit Supply Percentage

With the S2F deviation having both expected valuation and overcast time, we still have to deal with behavior and sentiment to find a good entry point. To get an idea of what the sentiment is during a correction, it helps to look at how many people are underwater with their bitcoin purchase. This is possible with the percentage of supply in profit metric, because while 70% of the supply is in profit, 30% is not.

Since the price of bitcoin has only been rising for a long time, it could be argued that new market players are the most likely to find themselves in an unrealized loss position. We also know that the younger the coins, the higher the likelihood of them being sold. Therefore, the likelihood of new entrants being panic sellers, who sell at a loss, is very high compared to investors who have been in the market longer.

The influence of the percentage of the offer in the profit (PSiP) is very important to identify a bottom and therefore an excellent entry. When the PSiP goes down during a correction and goes back up, it means paper hands have sold their bitcoin. Chances are that if enough bitcoins have been sold at a loss, the bottom will start to form. The new owners are not lost and will not be selling the newly acquired bitcoin anytime soon. Typically, these new owners are also high conviction investors who have been through multiple severe corrections.

If the PSiP is still low and continues to drop, it means the paper hands still have enough hopium and the capitulation needs to trigger before a bottom forms.

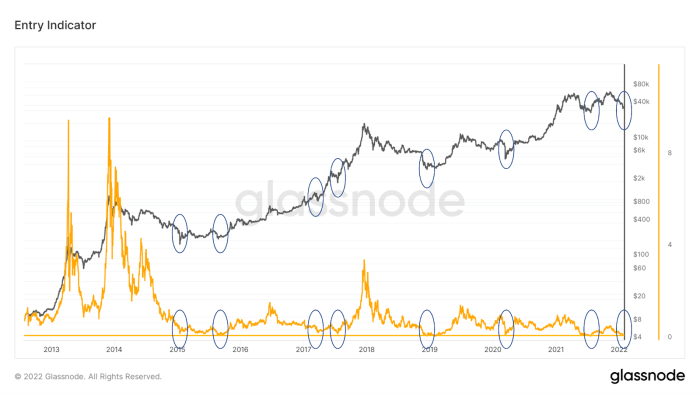

The entry indicator

Multiplying the stock-flow deflection (S2FD) with the PSiP gives a value ranging from 0.15 to one. It is only when the market price breaks above the S2F value that the indicator also rises, such as the blowout highs in 2011, 2013 and 2014. One might also notice that the lows of this metric form slightly lower troughs over the time, which would indicate that the minimum value would decrease with time. The descent from the bottom could be an indicator that S2F’s valuation is too bullish, but we’ll leave that open for debate.

When the indicator approaches 0.2, historically it has always been a great entry point. Note that these buy times are also displayed outside of bear markets. We could see that two buying opportunities are well presented in the bull run of 2017, but surprisingly also in mid-2021 and in the most recent one in January 2022.

Dynamic

The dynamic between the S2FD and the PSiP is extraordinary. Take January 6, 2021, for example. The market price was $36,850 and the S2FD was 0.987, and therefore the S2F price was $37,340. The PSiP was 100%. So every bitcoin HODLer (on-chain) was profitable. The Entry Indicator (TEI) gives 0.987 times 100% which equals 0.987. So the price was almost at par. Nobody was at a loss and the price was at the expected level for that time, so it was not a good entry point.

Let’s look at the moments in time when there was a big correction. On August 25, 2015, the price fell to $211.04 while the S2FD was 0.578 and the PSiP was 36.5%. TEI gave 0.21.

Fast forward to December 15, 2018, the price was $3,255 and the S2FD was 0.463 and the PSiP was 40.18%. TEI gave 0.186. Slightly more HODLers were profiteers than in 2015, but the gap between the market price and the S2F price was larger.

One might get a great entry during a bear market, but even during a bull market, such entries will present themselves. After hitting a new all-time high of $2,991 on June 11, 2017, we were back down to $1,914 within weeks. With a PSiP of 78%, one could argue if this would make a good entry. However, the S2FD was 0.35, which gave an EIR of 0.273. Looking back, it was actually a great entry point despite being in the middle of a bull run.

The same thing happened in the spring of 2021. On July 19, 2021, the price of bitcoin was $30,834 and the S2FD was 0.279, but the PSiP was only 65.8%, giving a TEI of 0.177. The result is almost the same as in 2018 and 2015, but it has a different structure. In 2015 and 2018, the S2F.D was less severe, but the offer at a loss was greater. In 2021, the S2FD was really big, which resulted in low numbers, but the lossy offering wasn’t that ugly.

There appears to be a correlation between bitcoin HODLers’ consensus on the price of each halving period and the amount of (unrealized) loss they will incur during that halving. In 2015 there was a consensus that the price was relatively high and when the price fell much of the supply was at a loss. In 2021, there was a consensus that the price was relatively low, but this also ensured that the supply held was not too exposed to (unrealized) losses.

Over time it seems like around 0.2 is a very good entry point and almost every time the real bottom. Spoiler alert, this time TEI was 0.2 at $35,000! Is it time for an entry?

This is a guest post by Johan Bergman. The opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or bitcoin magazine.