The below is a direct extract from Marty’s Bent Publish #1271: “Rising rates, begging and relative strength of bitcoin.” Subscribe to the newsletter here.

Last week we discussed the fact that credit default swap spreads for sovereign nations are falling completely off their historical averages. In this article, we have pointed out that the rapid rise in rates will begin to have a significant effect on interest payments on sovereign debt. Our friend Lawrence Lepard did some rough math on the exact impact this type of high rate environment will have on how much money the US government will owe its counterparts in interest payments if rates continue to rise. . At this rate, interest payments will be about 3.5 times higher than they were in 2020. Of course, that won’t happen right away, because many of these Treasuries need to mature. However, if you look at the maturity schedule, a considerable amount of these Treasuries will mature over the next couple of years.

Going through Laurent Lepard

Although interest payments on US sovereign debt may not reach $1.2 trillion immediately, they will begin to rise substantially in a relatively short time. It comes as tax revenues are almost certain to fall dramatically as Americans try to cope with a rate of inflation that screams far beyond what is being reported via the consumer price index. ; and as capital gains tax revenues dry up, as most will likely have to report losses on their stock holdings and home sales. Anyone with a shred of common sense and rudimentary math skills can see that this problem is about to have a significant effect on people’s confidence in the ability of the US government to pay its debts – and, by extension, on global confidence in the ability of the United States to be the “leader” of the Western world. It doesn’t matter how much the DXY rallies.

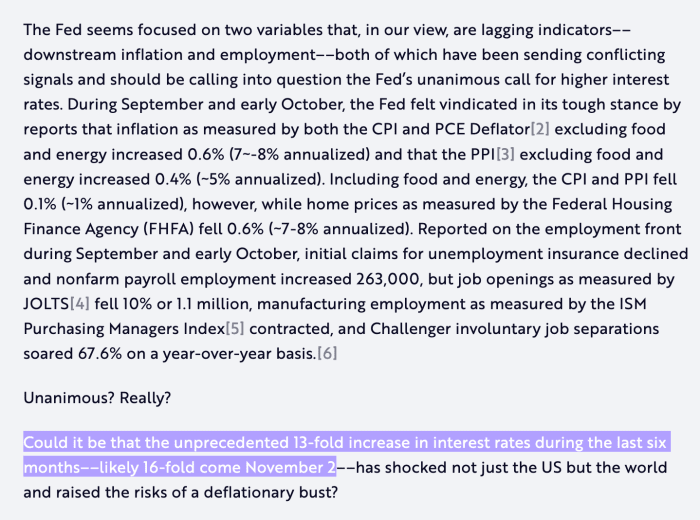

Not only that, but everyone who has become entirely dependent on the easy money that left the station in 2008-2009 is literally starting to implore the Federal Reserve to reverse its hawkish policy. In the last three weeks alone, we have seen the UN, the International Monetary Fund (IMF) and Cathie Wood of ARK Investment come out and directly and indirectly ask the Fed to back down.

(Source)

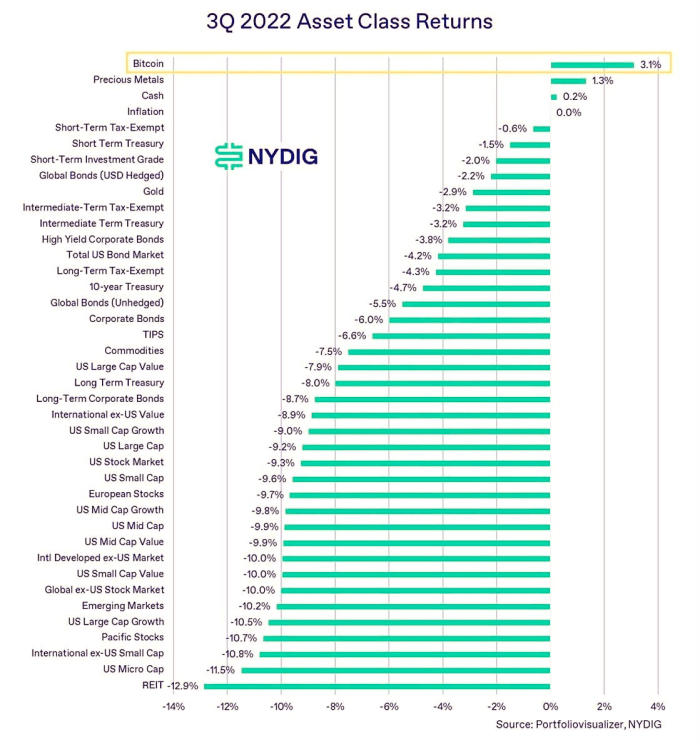

We find ourselves in very strange times. Everyone from the UN to the IMF to the big asset managers come out and admit that their way of being depends entirely on the butter sauce hurtling down the rails at top speed. They have built their worldview around a reliance on central planning and free money flows that drive up the prices of the assets they own and lull the world into a false sense of security. Markets have been forced to kick their heroin addiction out of the blue, and the withdrawal jolts are more violent than anyone could ever imagine they would be. The world wanders into uncharted territory. As heroin addicts beg their dealer to give them their fix, bitcoin is quietly showing relative strength in the background.

While those in the general public continue to poop between $18,000 and $20,000 in bitcoin after a drop of around 75% from highs reached late last year, the digital peer-to-payment system – nascent peer seems to be developing a stable base as everything around him begins to crumble at an increasing rate. This is something to watch in the weeks and months to come. Who knows whether or not this relative stability will continue to move forward? If so, as everything else continues to crumble, it would be a massive signal that there are likely to be more and more individuals recognizing the value proposition that bitcoin provides as a separate monetary good. from the whims of the central planners who set the world on fire.

Could decoupling be upon us? We will see.