This is an opinion piece by Kishin Kato, the founder of Trustless Services KK, a Japanese company primarily focused on Lightning Network research and development.

This is the third article based on content from the “Understanding Lightning” report produced by the Diamond Hands community, the largest Lightning Network community in Japan. The report aims to provide an overview of Lightning’s technology and ecosystem to a non-technical audience. The first article is available here, the second here.

Previous articles in this series have discussed how the Lightning Network excels in its payments use case and the possibilities it currently offers. While retail payments and international remittances are extremely powerful use cases for Lightning on their own, much more is possible.

In this article, we’ll explore some advanced use cases that Lightning may enable in the near future, with a particular focus on enabling various app use cases.

Activate peer-to-peer funding

Compared to other payment technologies, one of the defining characteristics of the Lightning Network is its peer-to-peer architecture. While it’s important to recognize that not everyone will realistically operate their own Lightning Node, it’s already relatively simple and straightforward to set up and operate one for personal use, and we can expect best practices for businesses operating Lightning Nodes to become more widely established. In the years to come. Ultimately, these factors will make it possible to provide simple and complex financial services on a peer-to-peer basis on the Lightning Network.

While Bitcoin Script’s limitations hinder on-chain enforcement of contracts using global consensus rules, Lightning Channel state is managed locally among the relevant peers, allowing various custom state management protocols to be explored. . Solutions such as DLCs aim to provide confidentiality and on-chain settlement of Contracts for Difference that rely on unconscious oracles, and similar contracts can be recreated over Lightning channels, enabling trust-minimized peer-to-peer exchanges, at least between peers who share a channel.

The trade-off space that can be explored is even larger if the relationship between these peers is such that trade-offs can be made regarding on-chain applicability, for example if the lack of trust is exaggerated and it is enough to to be able to prove fraud. These channels can handle concepts such as credit, settlement on other blockchains or databases, etc.

Credit-based channels already exist in limited capacity, commonly referred to as hosted channels, and are already being used to provide community banking services such as fiat-denominated Lightning channels (a touchy subject for another day). In theory, even exchange accounts can be represented as a hosted channel! Such constructs give us the flexibility to explore financial use cases and user experiences todayespecially when the service provided requires custody and trust anyway.

In addition to the possibilities that custom state management on individual channels can bring, this peer-to-peer funding limits systemic risk to the network. If a Credit-Based Channel provider is insolvent, Credit-Based Channels with its users may be affected, but other Network Channels will not (assuming they are not dependent on that provider behind the scenes ). Regular Lightning channels, in particular, are completely immune, as they are fully guaranteed and permissionless.

Finally, we are also seeing projects experimenting with token issuance schemes that allow transfers through Lightning. In my view, the advantages of this approach over others are unclear at best, as most tokens rely on the provision of services by a centralized party, and therefore may be better served by a centralized database or a star pattern. Nevertheless, there seems to be interest in developing tokens on Lightning, which could lead to useful innovations.

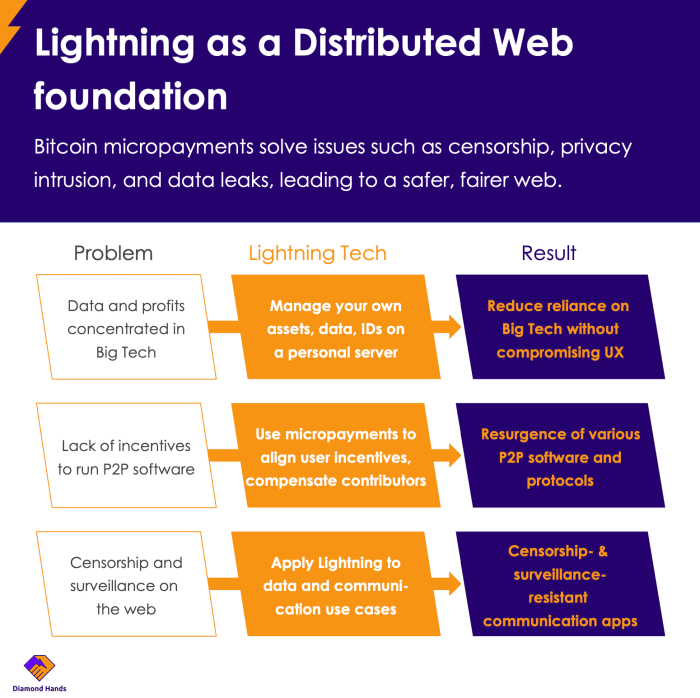

Payments on a more decentralized web

As a payment technology, it’s important to consider the problems that the Lightning Network is well positioned to solve. Given recent events, one answer is becoming increasingly clear: Lightning enables censorship- and platform-resistant payments.

Indeed, the Web5 concept announced by Jack Dorsey’s TBD project, is focused on building a decentralized application platform that aims to free users and developers from the grip of major technology platforms and processors. by separating identity, data storage, authentication and enforcement concerns. Distribution.

While Web5 itself doesn’t require the use of Lightning or bitcoin, obviously a web where users run servers to selectively feed data to apps has a strong synergy with Lightning (even though most choose not to run their own servers/nodes!). Indeed, while in no way representative of the general public, Lightning enthusiasts manage thousands of nodes, thanks in part to the efforts of projects like Umbrel, RaspiBlitz, and many other node managers.

In fact, since lightning payments are technologically an atomic exchange between pre-committed information (preimage) and bitcoin, it is particularly suitable for information payments, whether paid content, recovery of data or key material. There are already lapps (Lightning-powered apps) that explore some of these use cases.

Of course, even if attempts to decentralize the web application environment, including Web5, never take off – perhaps the majority of users and developers ultimately prefer the walled gardens provided by Big Tech, even with their drawbacks – the value of a politically neutral, censorship-resistant environment and easily verifiable money cannot be underestimated, as the trend of politicizing money continues. Even traditional all-custodial apps can benefit from interoperability with other apps that integrate Lightning deposits and withdrawals, as discussed in previous articles in this series.

Summary

The Lightning Network has enormous potential beyond just being a scalability solution for bitcoin payments. Since anyone can participate in the network without permission, there can be a diverse ecosystem of peer-to-peer financial service providers operating on custom vanilla and Lightning channels. Additionally, while the market does indeed see value in app platforms that resist capture by Big Tech and major payment processors, the Lightning Network has features that make it well suited for regular payments and conditional in such a context.

The road to mass adoption is long and not guaranteed, with countless hurdles to overcome. Even so, with the network’s steady growth and growing interest from developers, the Lightning Network is poised to become an interesting testing ground for peer-to-peer apps and finance.

This is a guest post by Kishin Kato. The opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.