The following is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Inflation is not over

Despite the general consensus and the sentiment of good news on inflation last month, the higher than expected US consumer price index (CPI) in August derailed any short-term bullish momentum for risk assets. which had been building over the past week. As a result, stock, bitcoin, and credit returns surged with some volatility today. The S&P 500 index closed down 4.3%, with bitcoin trailing more than 10% lower. The last time this happened for stocks in June 2020.

This is a similar event to what we saw last month for July data, but in reverse and with greater magnitude. Markets cheered last month’s wave of peak inflation trend confirmation, only for today’s data to say otherwise. We now look to the broader risk and rates market over the next few days to confirm this further downtrend or some relief with the meltdown expected to take place late tomorrow evening.

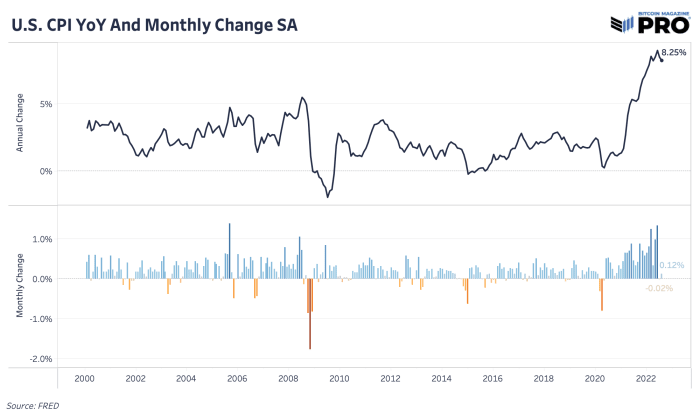

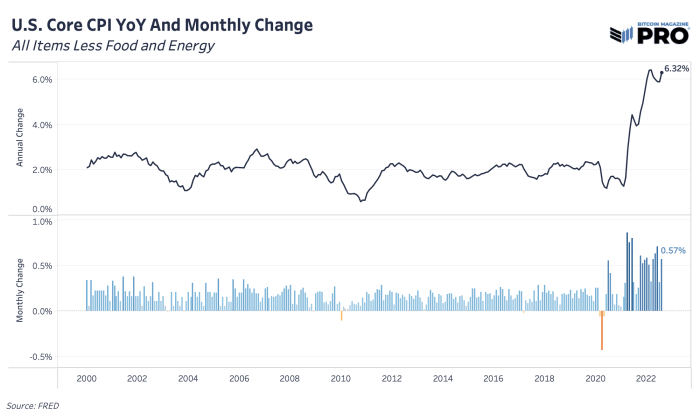

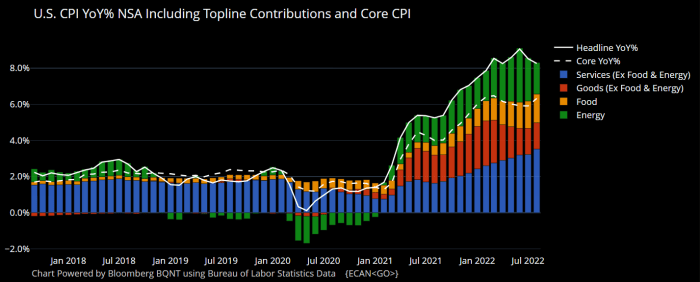

Headline CPI and Core CPI both beat expectations which had consensus positioning for a month-over-month deceleration. Instead, we saw headline CPI and core CPI rise month-over-month to 0.12% and 0.57% respectively. In simpler terms, inflation has not yet been defeated and there is still work to be done (or attempted to be done) on the monetary policy front. The Cleveland Fed Inflation Nowcast pretty much nailed their August forecast.

Although we saw some decline in inflation in energy commodities, this was not enough to offset rising inflation in the services sector. Higher and higher wage inflation remains a key and sticky element of inflation that has yet to come down. Housing inflation is also still a problem and has not abated yet. Inflation and housing prices have generally been the last to fall in a period of impending deflation and/or recession. Rent inflation (i.e. owners’ equivalent rent (OER)) is an important element that can sustain CPI prints for longer, as it is typically a lag of six at nine months.

Overall, the inflation picture looks persistent and widening. Based on statements from the Federal Reserve over the past few months, this is a clear sign to maintain aggressive monetary policy via rate hikes.

Source: Michael McDonough, Bloomberg

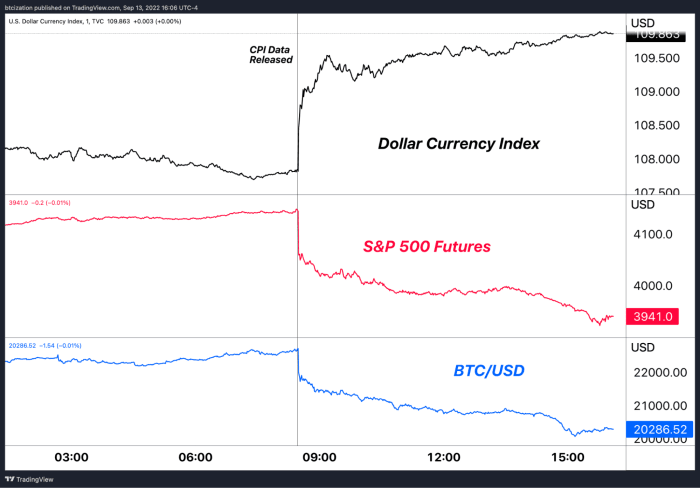

Immediately after the release of the CPI data, stocks and bitcoin started to sell off and the dollar soared. Asset class price action was tied less to inflation itself than to market expectations of the Federal Reserve’s future monetary policy.

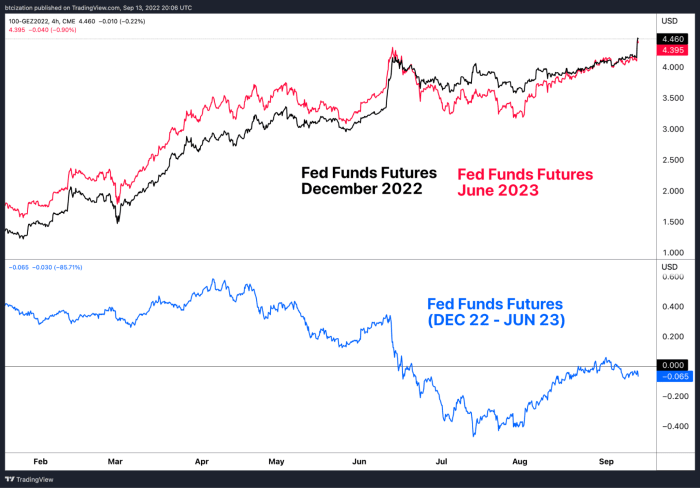

Rate expectations immediately hit new yearly highs, with the market now forecasting a fed funds rate of 4.46% for December this year, nearly 200 basis points lower than the current target rate range. from 2.25 to 2.50%.

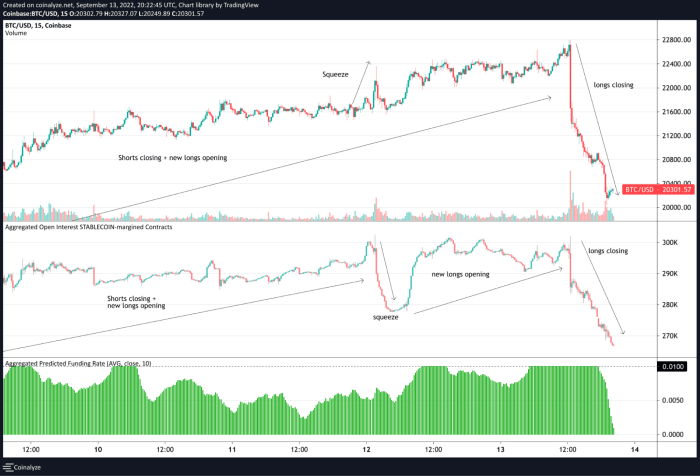

Bitcoin in particular saw a major unraveling in open interest as traders speculating on peak inflation by going long futures were now underwater in droves.

The drop in open interest on stable margin was more than 30,000 bitcoins between the release of CPI data and the close of traditional markets. Assuming that most of the drop in open interest was due to closing long positions, the market faced the equivalent of about 25% of MicroStrategy’s bitcoin reserve in selling pressure within a few minutes. hours.

That said, we are more convinced than ever of a final moment of capitulation that has yet to occur in global financial markets. Long-term investors should not fear downside volatility, but rather embrace it, understanding the unique opportunity it presents to buy high-quality assets at bargain prices.