The following is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin magazine premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

Options and Derivatives Update

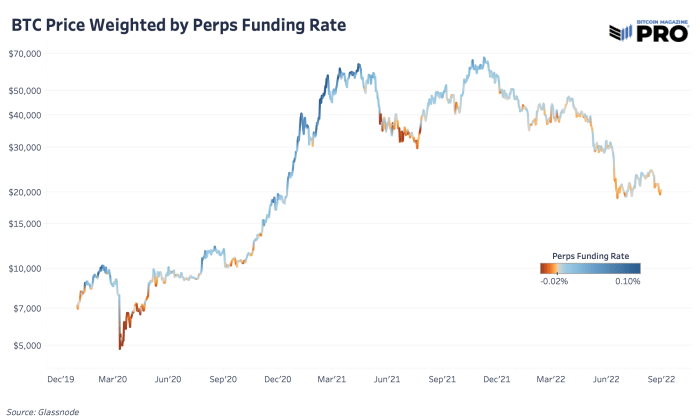

A dynamic and chart we’ve covered extensively before is Bitcoin’s perpetual futures market funding rate versus price. In the previous bull run of 2021, the perpetual futures (perps) market played a key role in moving short-term prices both up and down with excessive leverage. It’s worth reviewing the state of the derivatives market and the system’s current leverage, as bitcoin’s price has crashed since its last rally, following US stocks on a potential path to new highs. hollow.

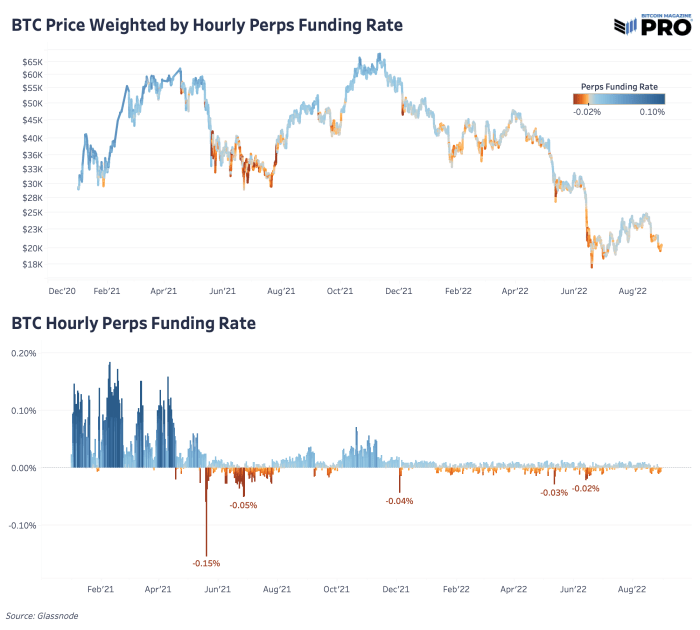

Since the peak in November 2021, the perpetual futures market has been consistently trending down (neutral funding rate is 0.10%). Simply put, more market participants were and still are short-term biased over the past eight months. Even in the last bear market rally, that hasn’t changed. We haven’t seen the funding rate move beyond neutral territory, which clearly shows that long speculators and risk appetite have not returned to the market.

With the successful launch of a bitcoin futures ETF in US markets last fall, along with a general unwinding of speculative activity in the bitcoin/cryptocurrency market, perp funding rates have tumbled from a neutral short bias with much less explosive moves in funding rates. . Although the dynamics of the derivatives market have changed, it is still worth watching for an actionable signal from the perps market where the short selling bias becomes strongly out of play, as has been demonstrated throughout the history, marking significant lows. It should be noted that in previous bear market cycles (where new incoming spot demand was diminished by willing sellers), funding could remain negative for long periods of time, due to lack of demand to speculate/exploit the active bulls.

In previous bitcoin bear markets, funding could stay negative for long periods of time due to lack of demand to speculate/mine BTC.

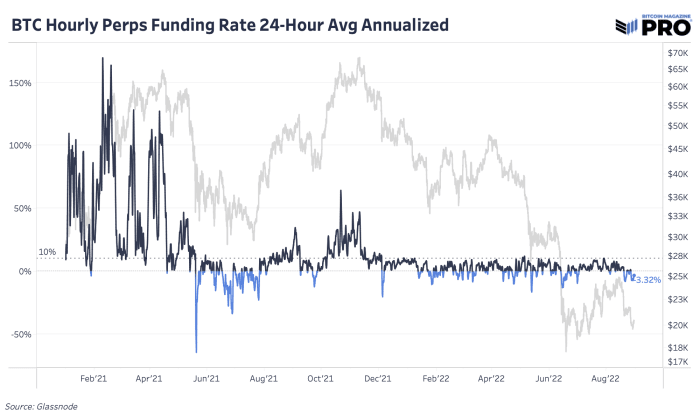

Another way to view the funding rate is to look at an annualized value with current negative funding rates giving around 3.32% for taking a long versus the majority of shorts. Since the November 2021 blackout, the market has yet to break above the annualized neutral funding rate.

The price has moved with the downward trend in open interest in the USD futures market since the market top. This is best seen in the second and third charts below, which only show the futures perps market share of all futures open interest. The perp market accounts for the lion’s share of open interest at over 75% and has grown significantly from around 65% at the start of 2021.

With the amount of leverage available in the perp market, it makes sense that perp market activity would have such a large impact on price. Using a rough calculation of Glassnode’s total perp market volume of $26.5 billion per day (7-day moving average) versus Messari’s actual spot volume (7-day moving average adjusted for trading volumes). (inflated exchange) of $5.7 billion, the perp market is trading nearly five times the volume to spot the markets. On top of that, daily spot volume is down almost 40% from a year ago, a statistic that helps to understand just how much liquidity has left the market.

Considering the volume of bitcoin derivative contracts compared to spot markets, one can come to the conclusion that derivatives can be used to suppress bitcoin. In fact, we disagree, given the dynamically priced interest rate associated with Bitcoin futures products, we believe that over a long enough period, the effect of derivatives is net neutral on price. While bitcoin probably exploded much higher than it otherwise would have due to the reflexive effects of leverage, these positions were eventually forced to close, thus an equal negative reaction was absorbed by the market.