The second anniversary of the first of three coronavirus economic impact payments (aka “stimmy” stimulus checks) deposited into US taxpayers’ bank accounts came and went on April 11, and headlines on the monetary inflation, a possible economic recession and generally gloomy financial problems tailwinds are everywhere.

Bitcoin’s ethos is diametrically opposed to the perceived reckless spending and money printing that has characterized the past two years, especially with bitcoin miners tasked with issuing new units of bitcoin at predetermined intervals and not malleable. So at this point it’s perhaps appropriate to revisit the returns that people who received stimulus checks would have enjoyed had they invested their dollars in bitcoin mining and the alternative financial world that he supports.

Bitcoin stimulus check story

Before we analyze the mining-specific data, it’s worth remembering how quickly the narrative that supported the investment of stimulus money in bitcoin exploded across all social media channels before the first checks are signed or mailed. Support for this meme was so strong that several polls were subsequently conducted to quantify exactly how many Americans actually exchanged their free fiat currency for bitcoin or other cryptocurrencies.

Coinbase, the largest US-based bitcoin exchange by volume, fueled the new bitcoin by sharing data that showed an increase in stimulus check-sized bitcoin buy orders on its platform. form as the checks were mailed.

Bitcoin’s capped and predictable supply acted as the perfect foil for the inflationary and unpredictable monetary policy created in real time in response to the coronavirus situation. The very month the first checks were mailed, a Twitter account was created to track the dollar value of the first stimulus check ($1,200) if fully invested in bitcoin. The account is still tweeting updates today.

But beyond bitcoin itself, what returns would stimulus check recipients have received if they spent their free money on mining stocks?

Mining Stock Price Performance

Dumping stimulus dollars sent by the US Treasury into Bitcoin mining stocks has reportedly yielded a pretty handsome profit over the past couple of years. Through 2020 and 2021, Americans received three rounds of stimulus checks in April 2020, December 2020, and March 2021 totaling $3,200.

The bigger question is, of course, which mining stocks to buy?

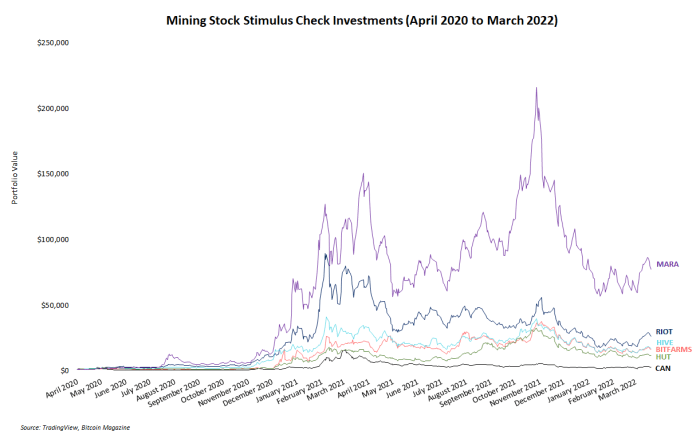

In the table below, the maximum and current values of what might be called a “stimulus control wallet” are compared based on investments in one of a few major public bitcoin mining companies (c i.e. Bitfarms, Canaan, Hive, Hut 8, Marathon or Riot). ). At their peak, each of these investments was worth over $15,000, with a torque of six figures or so. But the current stimulus wallet values are down along with bitcoin itself.

Maximum and current “stimulus control wallet” values compared to investments in major public bitcoin mining companies

Perhaps some stimulus check investors would have invested in a basket of mining stocks, instead of just one. But for the sake of simplicity, this article only considers investments in one of a few major stocks. The line chart below visualizes the time series data for the issuance of each of the three checks and the fluctuations in value for each of the companies included in the table above from April 2020 at the time of this writing. .

Even though most of these investments are trading below their highs, their stimulus check-funded investors have been sitting on three- and four-digit percentage returns at various times over the past two years. And to this day, these investors are still heavily in the dark on these orange coin stocks. Overall, not bad.

Why mine stocks?

Instead of just buying bitcoin, some investors also prefer to own mining stocks to gain even more exposure to the bitcoin market and potentially outperform bitcoin itself. Mining stocks have a strong positive correlation with the price movement of bitcoin, which means that when bitcoin and other major cryptocurrencies are in uptrends, it’s no surprise to see market tailwinds raise the stock prices of public mining companies. And when bitcoin falls, mining stocks also fall.

But mining stocks are generally considered a leveraged play on bitcoin, so when bitcoin goes up or down, mining stock prices follow the same direction but with bigger moves of their own. So, if a particular bitcoin investor is extremely bullish, buying mining stocks in hopes of outperforming bitcoin itself is a reasonable strategy.

In addition to using mining stocks to speculate on bitcoin, these investments also provide easy exposure to the mining industry. Mining is a capital-intensive business, and most industry processes and frameworks have yet to mature and be standardized. Bitcoin bulls who want exposure to this industry without the headaches of sourcing machinery, building a mine site, or maintaining operations often choose to simply buy shares of mining companies.

Similarly, mining stocks also offer principled bitcoin investors the opportunity to diversify their portfolios and potentially outperform their primary investment (BTC) without allocating capital to alternative cryptocurrencies. Without derailing this article with altcoin politics, the primary goal of most active bitcoin investors is to find a way to outperform the price of BTC. Most altcoins typically outperform bitcoin in dollar-denominated returns, but many bitcoin holders reject altcoin investments on principle, if nothing else. Mining stocks are bitcoin-centric investments that can outperform bitcoin in bull market cycles without compromising the ideals of some bitcoin holders.

In short, where bitcoin price will go next is not always clear. But whichever direction that takes, mining stocks will almost certainly follow.

If You Invested Your Stimulus In Bitcoin Mining Stocks, You Are Not Disappointed

For many Americans, stimulus funds have been spent on things arguably far more important than Bitcoin mining stocks (e.g., rent payments, utility bills, groceries, emergency savings ). But for other recipients who weren’t significantly impacted by the economic turmoil following the coronavirus response measures, the data visualized in this article shows that the free money was an opportunity to invest in critical infrastructure supporting the network. Bitcoin. And the short-term returns from these investments have not been disappointing.

This is a guest post by Zack Voell. The opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.