The following is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine premium markets newsletter. To be among the first to receive this information and other on-chain bitcoin market analysis straight to your inbox, Subscribe now.

New record hash rate

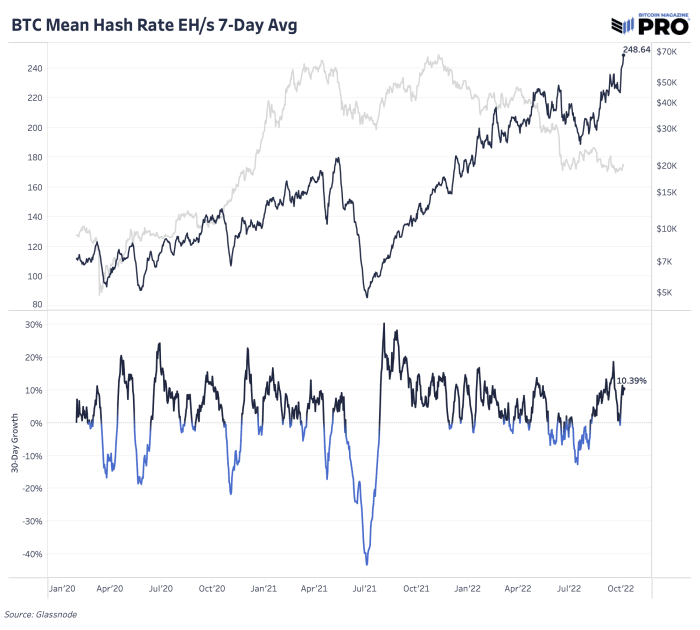

Just two months ago, the 2022 Bitcoin hash rate expansion looked grim. The price of bitcoin had plummeted, miner margins were compressing, large public miners were losing their bitcoin holdings, and it was time to review the state of miner capitulation in the market. Fast forward to today: price descended from a massive bear market rally to $25,000 while the online hash rate exploded to a new all-time high of nearly 250 EH/s. The hash, range and rallies in bitcoin price have not impacted the hash rate which has been rising this year. The hash rate hasn’t really declined on a 30-day growth basis since July.

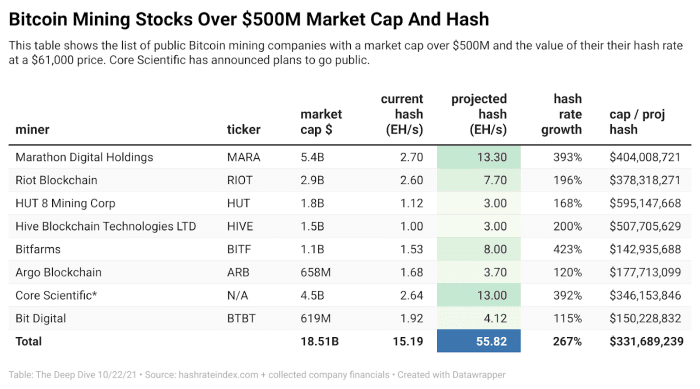

This is some of the best public data available to explain why bitcoin’s hash rate has skyrocketed so much. These are public miners who execute expansion plans. But that doesn’t mean large-scale mining companies haven’t faced additional pressures. Compute North, one of the largest data center operators and bitcoin mining hosting services, filed for Chapter 11 bankruptcy just a few weeks ago. They housed miners for companies like Marathon Digital, Compass Mining and Bit Digital in 84 different mining entities. A major auction of the bulk of Compute North’s existing assets will take place on November 1, 2022, including mining containers, machinery, and entire data centers.

When Celsius collapsed, Celsius Mining also filed for bankruptcy in July. That said, it’s clear from Compute North’s recent bankruptcy that the pressure is still on large-scale miners. They are not out of the woods yet and we have been hesitant to call for an end to the miner capitulation this cycle as the price has stagnated and the hash price (miner’s income divided by the hash rate) continues to face strong headwinds with this level of hash rate expansion underway.

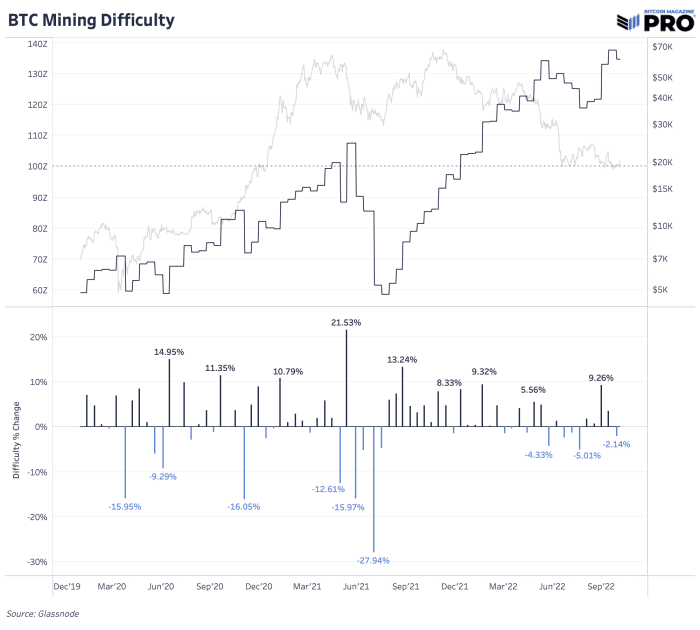

After hitting a new all-time high, mining difficulty saw a decently sized negative adjustment of 2.14% just before this hash rate explosion over the past week. But that seems like a short-term relief, as right now the next projected difficulty adjustment looks like a vicious 13.5% positive adjustment at the time of writing. We haven’t seen this level of adjustment since just after the Chinese mining ban. This type of adjustment would be bad news for the profitability of existing miners, as the hash price would come under additional pressure.

It takes incredible operational excellence to continue to excel in the bitcoin mining industry over multiple cycles.

This is why stock investments related to bitcoin mining can be extremely lucrative (if you pick one of the winners) or downright disastrous.

In our article of December 21 last winter, we said the following,

“What you should understand when evaluating the performance of exchange-listed miners against bitcoin itself is that due to the capital structure of their business and the valuations present in the exchanges, miners can and will likely outperform bitcoin over periods when the hash price rises significantly.

“However, in the long run, revenue in terms of bitcoins for every mining company is guaranteed to decline in terms of bitcoins, and due to the excessively high earnings multiples that companies are currently trading with on stock exchanges in a world of high interest rates. zero interest, even bitcoin mining stocks tend to zero over time in bitcoin terms (again, due to equity multiples awarded in a zero interest fiat-denominated world ).

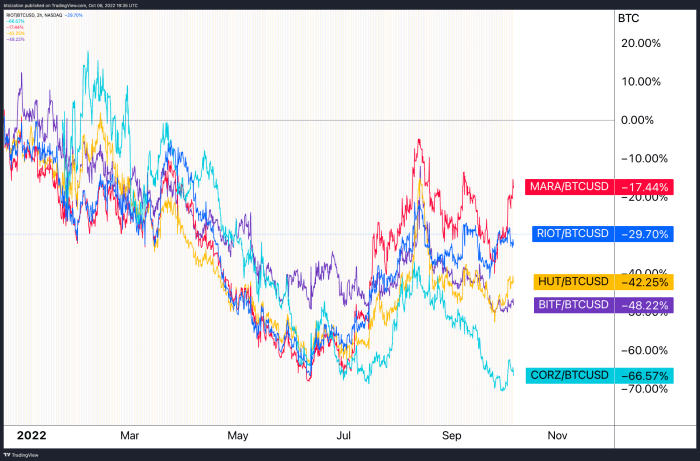

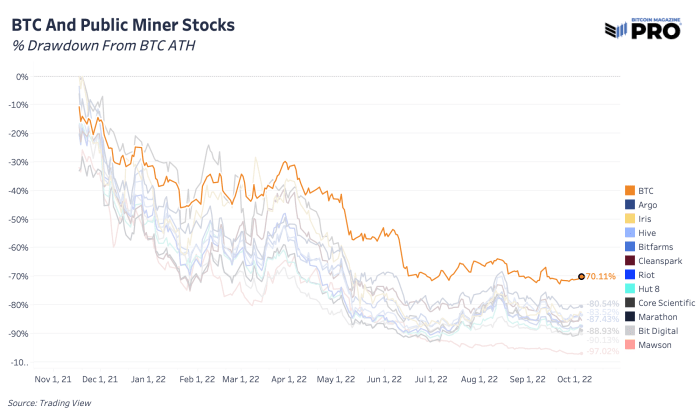

Since then, the stock prices of publicly traded mining companies have all fallen significantly relative to bitcoin itself.

This should come as no surprise. Miners’ margins are shrinking relentlessly as profits shrink, both in bitcoin and in dollars.

Since the all-time high in bitcoin’s price, all listed mining companies have underperformed the asset itself, without exception.

While mining-related stocks can certainly appreciate from their currently battered valuations, the advancement of mining machinery and the economic incentives of mining ensure that the hash rate continues to rise from from here.

To quote one of our previous issues,

“However, the dynamics involved in the valuation of exchange-listed bitcoin miners are a bit different. Unlike other producers of ‘commodities’, bitcoin miners often attempt to keep as much bitcoin as possible on their balance sheet. Along the same lines, the future issuance of bitcoin supply is known in the future with near 100% certainty.

“With this insight, if an investor is pricing these stocks in terms of bitcoin, significant outperformance relative to bitcoin itself is achievable if investors allocate at the right time during the market cycle using a data-driven approach.”

Going forward, mining-related stocks as well as ASICs will once again be poised for strong outperformance against bitcoin itself. We don’t think that time has come yet.

Relevant previous articles